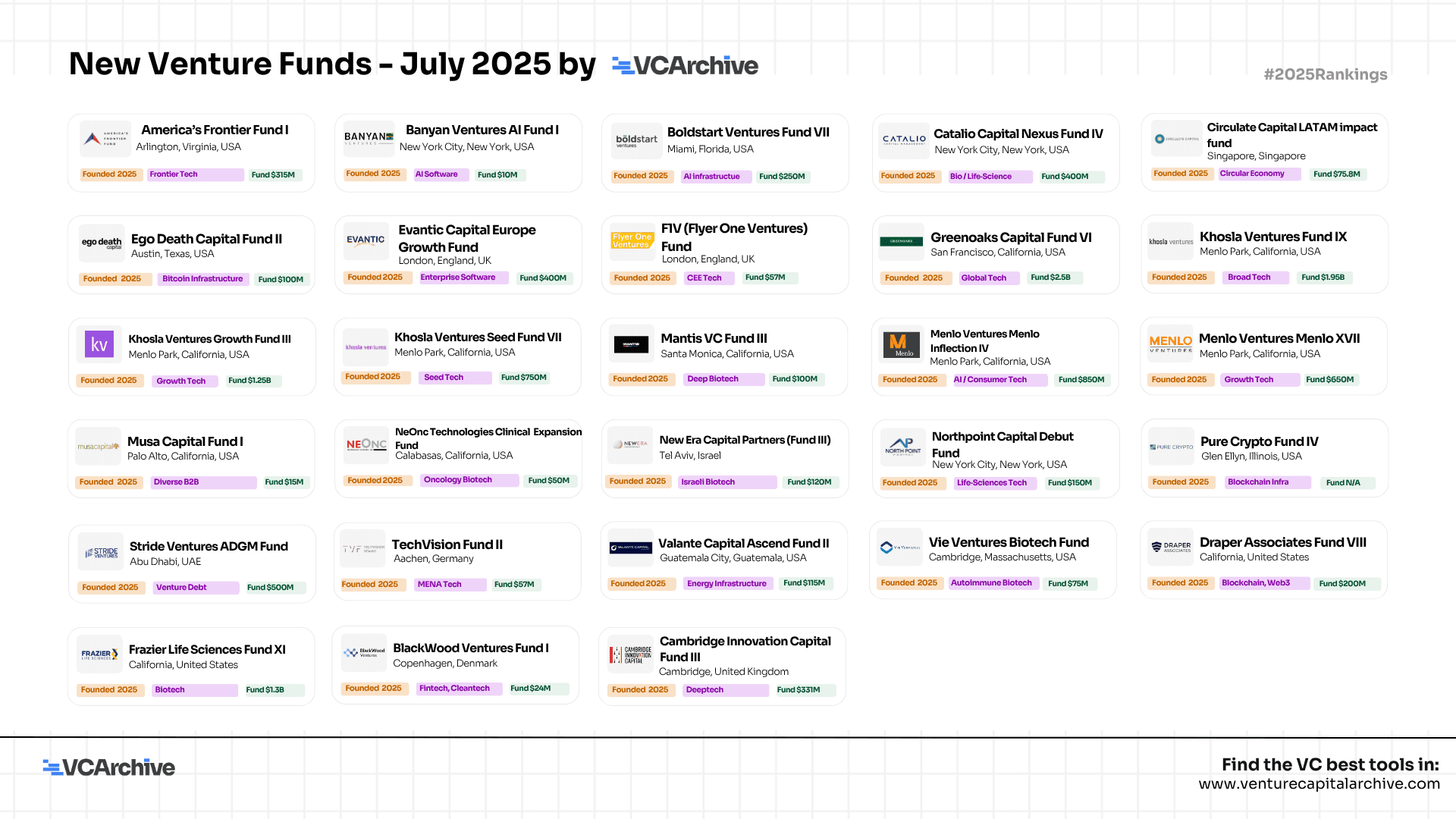

New Venture Funds - July 2025

The funds span a diverse range of sectors, from AI software, biotech, and deep tech to blockchain infrastructure, climate capital, and circular economy initiatives. Notably, this month saw an influx of specialized, thesis-driven funds: from Catalio Capital’s life sciences vehicle and Mantis VC’s deep biotech fund to Pure Crypto Fund IV and Circulate Capital’s LATAM impact vehicle.

Geographically, the United States remains dominant, with heavy activity in California and New York, but new funds also launched out of London, Copenhagen, Singapore, Calabasas, Dubai, Aachen, and Guatemala City. A clear sign that capital formation is becoming increasingly international.

Most of the July 2025 funds are focused on early-stage investing, including Pre-Seed, Seed, and Series A. Several standout fund sizes were also disclosed, ranging from $25M debut vehicles like BlackWood Ventures Fund I to heavyweight funds like Khosla Ventures Seed Fund VII ($750M), Menlo XVII ($650M), and Boldstart Ventures Fund VII ($250M).

The most common sectors include:

- AI Software & Deeptech (Banyan Ventures AI, Cambridge Innovation Capital)

- Life Sciences & Biotech (Frazier Fund XI, NeOnc Clinical Expansion, Vie Ventures)

- Blockchain & Web3 (Ego Death Capital II, Pure Crypto IV, Draper VIII)

- Circular Economy & Sustainability (Circulate Capital LATAM, Valante Capital Ascend)

- Enterprise Tech & SaaS (Evantic Capital, Northpoint Capital)

This curated roundup provides a snapshot of the strategic direction of capital deployment toward foundational technologies, scientific breakthroughs, and next-gen infrastructure.

Whether you're a founder raising capital or an LP mapping fund performance, this list captures where the most thesis-driven capital is emerging.

Explore the full list of New venture funds launched in July 2025, including their sector focus, fund size, and global HQ - now live on VCArchive.

New Venture Funds - July 2025

Rows per page